Trust what’s real and detect what’s fake

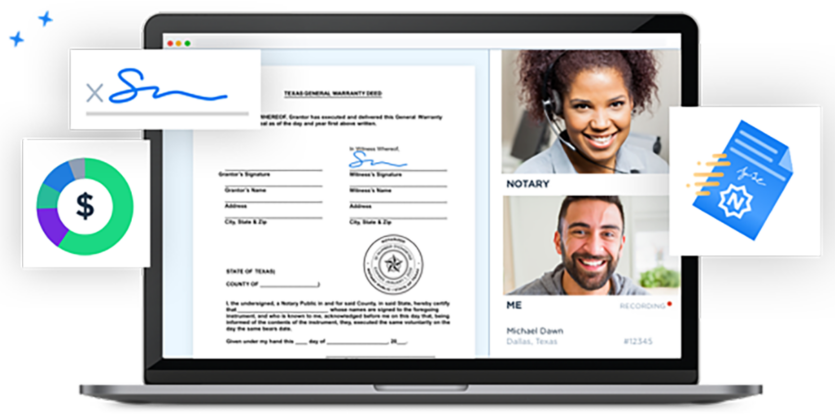

These days, you can do just about anything online—even visit your doctor. So why do you still need to drive across town just to get someone to notarize a document?

That compelling question spurred co-founders Pat Kinsel and Adam Pase to launch Notarize, a firm that—with the help of Camber Creek—is bringing online document verification to some of the largest companies in the world.

Through Notarize, consumers and businesses can connect with an online notary public 24-7 using a computer, tablet, or smartphone.

Of course, achieving scale meant Notarize needed to work with major businesses and other digital products. That’s why Camber Creek:

- Introduced Notarize to some of the leading real estate groups in the country; six of them soon became customers.

- Invested in the firm’s Series B round and led the Series C.

“Camber Creek has been an amazing partner for us,” Pat says. “From their presence on our board to helping us land major partnerships with leading real estate groups and corporations like Adobe, they’ve been tremendous.”

Now known as Proof, notarization is one of the solutions the company offers. Proof is adding layers of trust to online transactions with products that use a combination of human and digital verification to give all parties assurance. Their software provides an effective counter against the range of tools available to falsify financial records, income, and even identity.

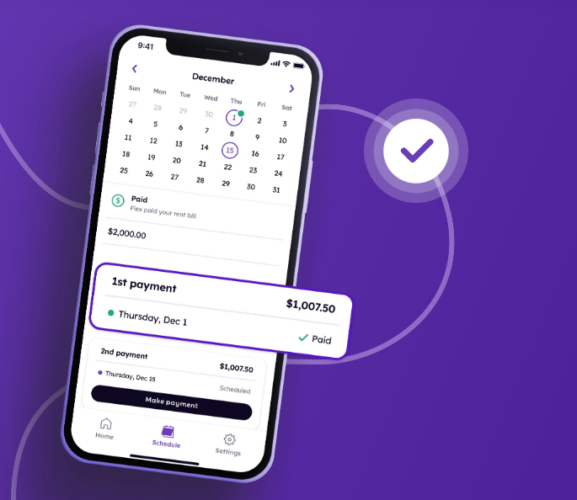

Paying rent on your own schedule is a beautifully simple concept. We’re glad the team at Flex finally solved this challenge.

Most Americans receive paychecks biweekly while rental payments are due at the beginning of the month. It’s one part of the reason tens of millions of people are one injury, mishap, or accident away from falling behind. For a monthly fee, Flex will pay a renter’s lease payment when due, allowing the renter to repay that amount on a flexible schedule of their choosing over the course of the month. This arrangement guarantees a landlord will receive rent on time and in full while giving tenants financial flexibility. Since Flex functions as a credit line, timely repayment helps a renter build credit. Best of all, Flex’s technology makes the process seamless and frictionless for both landlords and tenants, which has made Flex one of the fastest–growing companies in our portfolio.

“Camber Creek helped me refine the idea for the product,” says CEO Shragie Lichtenstein, “and after introducing me to a number of their limited partners in the multifamily space, we received strong evidence of the types of buildings where Flex would be most attractive. It’s the type of insight that could have taken years of trial and error, but Camber Creek helped us find that fit before they even invested as a standard part of their due diligence process.”

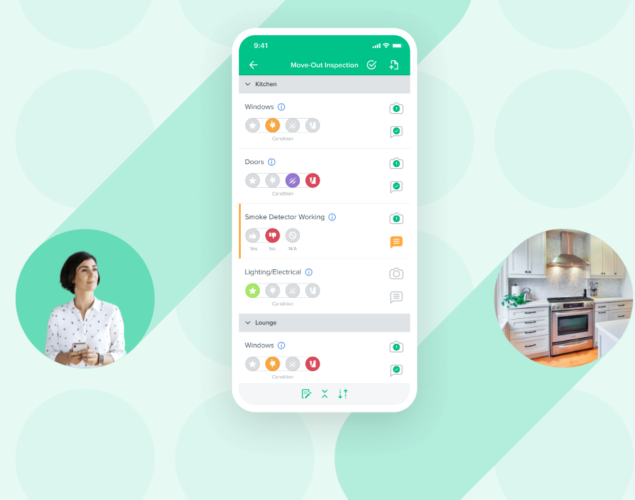

Moving can be incredibly painful. Not just for tenants, but also for landlords.

Owners need to refresh vacated units while also collecting the proper data and documentation for reporting. This reporting is necessary to accurately budget for upgrades or resolve tenant disputes.

Camber Creek met HappyCo co-founder Jindou Lee early in his quest to solve these challenges. Jindou was so focused on making this painful process simple and making customers happy that he named the company HappyCo. True to character, Jindou tackled this problem with best-in-class software and service while building the largest inspection software company in the multifamily industry, all with a smile on his face.

After years of knowing Jindou and observing HappyCo’s execution, we knew we wanted to lead HappyCo’s Series B so that the company can provide an even broader array of industry-leading products and services.

“My relationship with Camber Creek began years before they invested,” said Jindou. “They are amazing people and tremendously valuable partners and board members. They always go above and beyond what they say they are going to do. Who wouldn’t want to work with a team like that?”

Today, HappyCo has data on over 3.5 million multifamily and single-family rental homes, including one out of every eight professionally managed units in the US. HappyCo data is relied upon for approximately 26% of all US sale transactions of multifamily units.

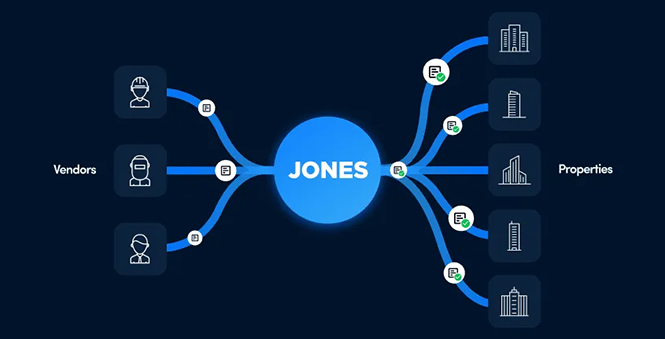

Jones lets you know who you can trust.

For real estate managers, tenants, and vendors in commercial properties, the risk-and-compliance process is a major roadblock to doing business. Because of strict liability rules, every vendor entering a property to do business must have an approved certificate of insurance (COI). To process this certificate, each property manager and tenant must complete a handful of cumbersome manual tasks, waiting on average two weeks for approval. Jones provides an end-to-end software solution that removes manual COI processes.

Jones confirms insurance coverage and identifies gaps in coverage that could be costly. This allows property and construction site managers to identify and quickly protect against risks that could otherwise be costly; assign liability to the right party; get vendors certified and on site in hours, not weeks; and make payment contingent upon compliance. Vendors save time and money, because their credentials follow them from site to site within Jones’ system.

Jones now covers more than 1.2 billion square feet of real estate.

Camber Creek introduced Jones to a number of its current customers and advises on corporate strategy.

“When you’re raising venture funding, one of the biggest early hurdles is ensuring the funder really understands the problem you’re attacking,” says Co-Founder and CEO Omri Stern. “Camber Creek’s partner team comes from the real estate industry; they appreciated what we were doing and the scale of the opportunity immediately. That expertise shows up in everything they do, from the questions they asked during due diligence to the strategy and planning they are part of on our board. They earned our trust early.”

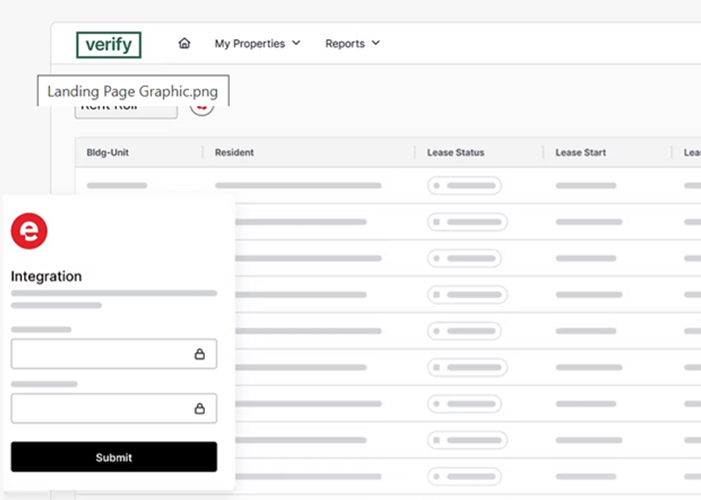

In commercial real estate transactions, data transparency builds trust. Trust enables greater speed and greater volume. Verify helps lenders and property owners get more done.

Commercial real estate lenders need detailed insight into the performance of the underwritten asset. Assembling that information for thousands of units across many buildings with data siloed in separate property management systems creates an enormous manual reporting burden.

Verify is a centralized platform that allows owners and lenders to aggregate, standardize, and share data seamlessly without manual intervention. Verify streamlines reporting of loan and property data for lenders, borrowers, and servicers. The company’s software sits on top of borrowers’ legacy property management systems, enabling more efficient and accurate loan reporting. Lenders can invite borrowers into the system, and borrowers can automatically set up reports. Lenders get data directly from the source, and borrowers get the benefit of faster reporting and transaction times, removing days or even weeks of delay.

Camber Creek has been advising Verify from its earliest stages.

“Being an early-stage founder requires a tremendous amount of improvisation and decision-making on the fly,” says Verify Founder and CEO Rachel Chern. “That’s just the nature of building anything new. But Camber Creek has helped startups progress through every stage of growth many times before. While there is no magic playbook, their experience and perspective are the next best thing.”