Jones lets you know who you can trust.

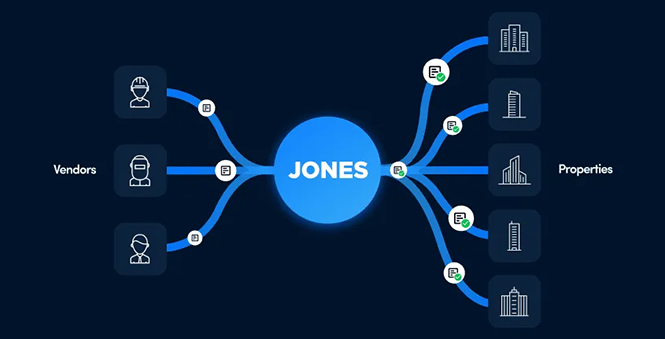

For real estate managers, tenants, and vendors in commercial properties, the risk-and-compliance process is a major roadblock to doing business. Because of strict liability rules, every vendor entering a property to do business must have an approved certificate of insurance (COI). To process this certificate, each property manager and tenant must complete a handful of cumbersome manual tasks, waiting on average two weeks for approval. Jones provides an end-to-end software solution that removes manual COI processes.

Jones confirms insurance coverage and identifies gaps in coverage that could be costly. This allows property and construction site managers to identify and quickly protect against risks that could otherwise be costly; assign liability to the right party; get vendors certified and on site in hours, not weeks; and make payment contingent upon compliance. Vendors save time and money, because their credentials follow them from site to site within Jones’ system.

Jones now covers more than 1.2 billion square feet of real estate.

Camber Creek introduced Jones to a number of its current customers and advises on corporate strategy.

“When you’re raising venture funding, one of the biggest early hurdles is ensuring the funder really understands the problem you’re attacking,” says Co-Founder and CEO Omri Stern. “Camber Creek’s partner team comes from the real estate industry; they appreciated what we were doing and the scale of the opportunity immediately. That expertise shows up in everything they do, from the questions they asked during due diligence to the strategy and planning they are part of on our board. They earned our trust early.”